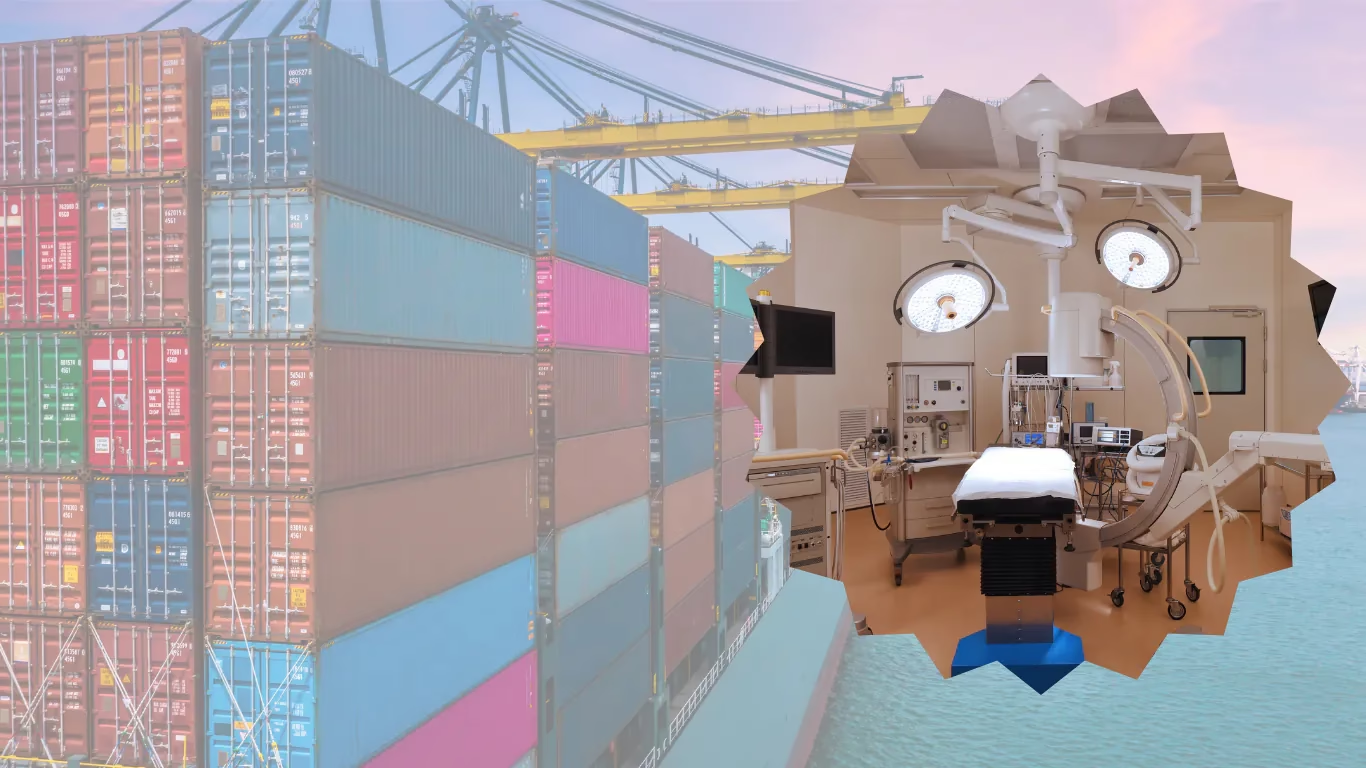

India’s medical devices industry continues to depend heavily on imports even as exports show steady momentum. Around 70-80% of domestic demand is met through overseas purchases, especially for high-end and technologically advanced equipment. Total imports are estimated at $8.6 billion more than double the country’s exports and have grown at a CAGR of 7.1%. Electro-medical devices alone account for nearly 60% of these imports.

Export paradox

While imports dominate, India has carved a niche in the export of consumables, which made up nearly 47% of total exports between April and September FY25. According to Rubix Data Sciences, the sector is valued at $15.2 billion in 2025 and is projected to expand at a CAGR of 26.9% to reach $50.1 billion by 2030.

India is currently the fourth-largest medical devices market in Asia and ranks among the top 20 globally, with around 800 domestic manufacturers operating in the space. Private equity and venture capital investments in the sector have also risen sharply from $56 million in 2022 to $137 million in 2024.

Growing income levels, wider health insurance coverage, improved healthcare infrastructure, and the expansion of medical tourism are driving demand for both affordable and mass-market devices. India remains competitive in cost-efficient, large-scale manufacturing, particularly in low- to mid-technology products.

Government initiatives such as the National Medical Devices Policy, the Production-Linked Incentive (PLI) Scheme, MedTech Mitra, and the Scheme for Promotion of Medical Devices Parks have further supported the industry’s growth.

Policy catalysts

States including Uttar Pradesh, Maharashtra, Haryana, and Karnataka are emerging as key hubs for the sector by providing shared infrastructure, skilled workforce, and supplier ecosystems. This has particularly benefited small and mid-sized manufacturers, the report noted.