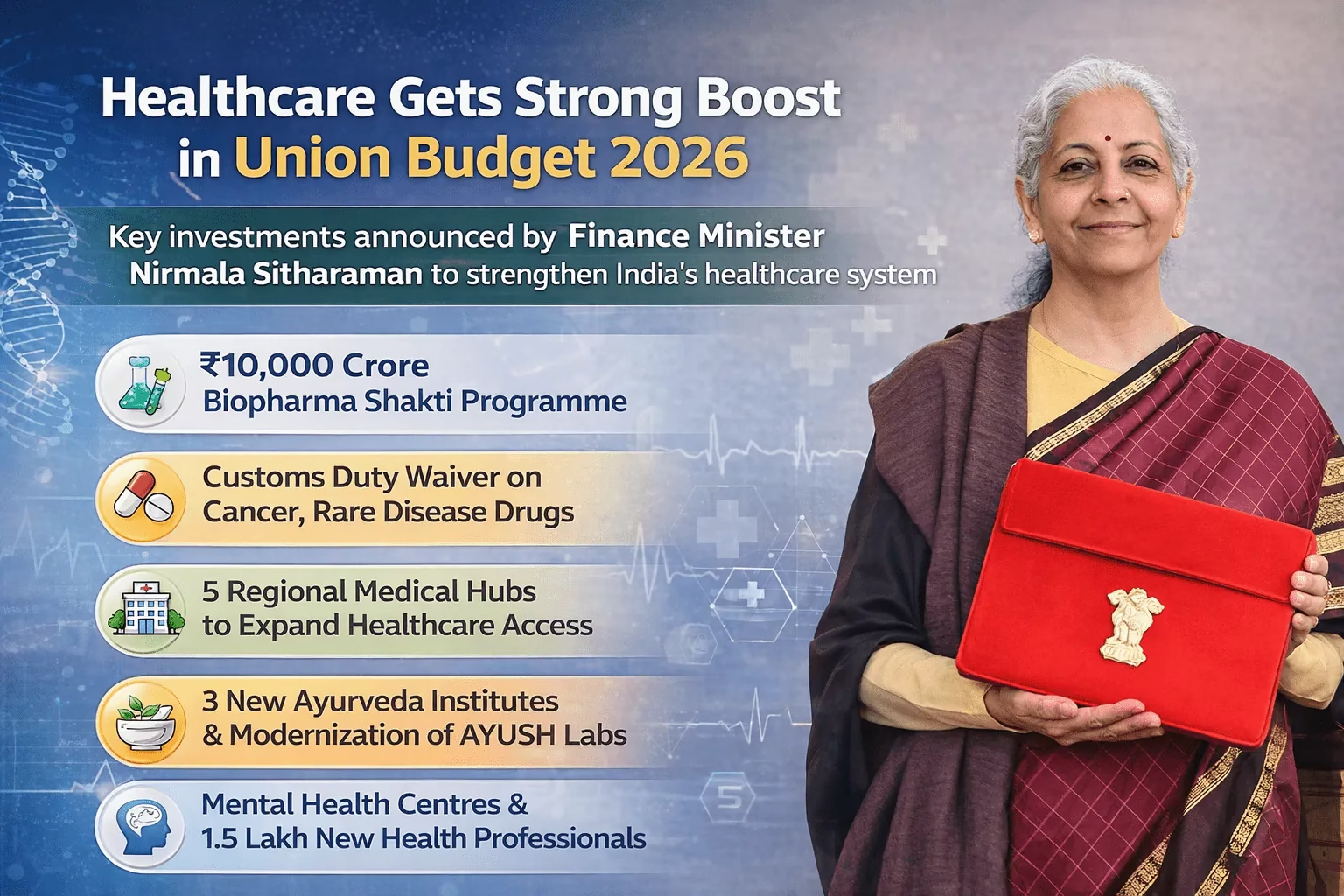

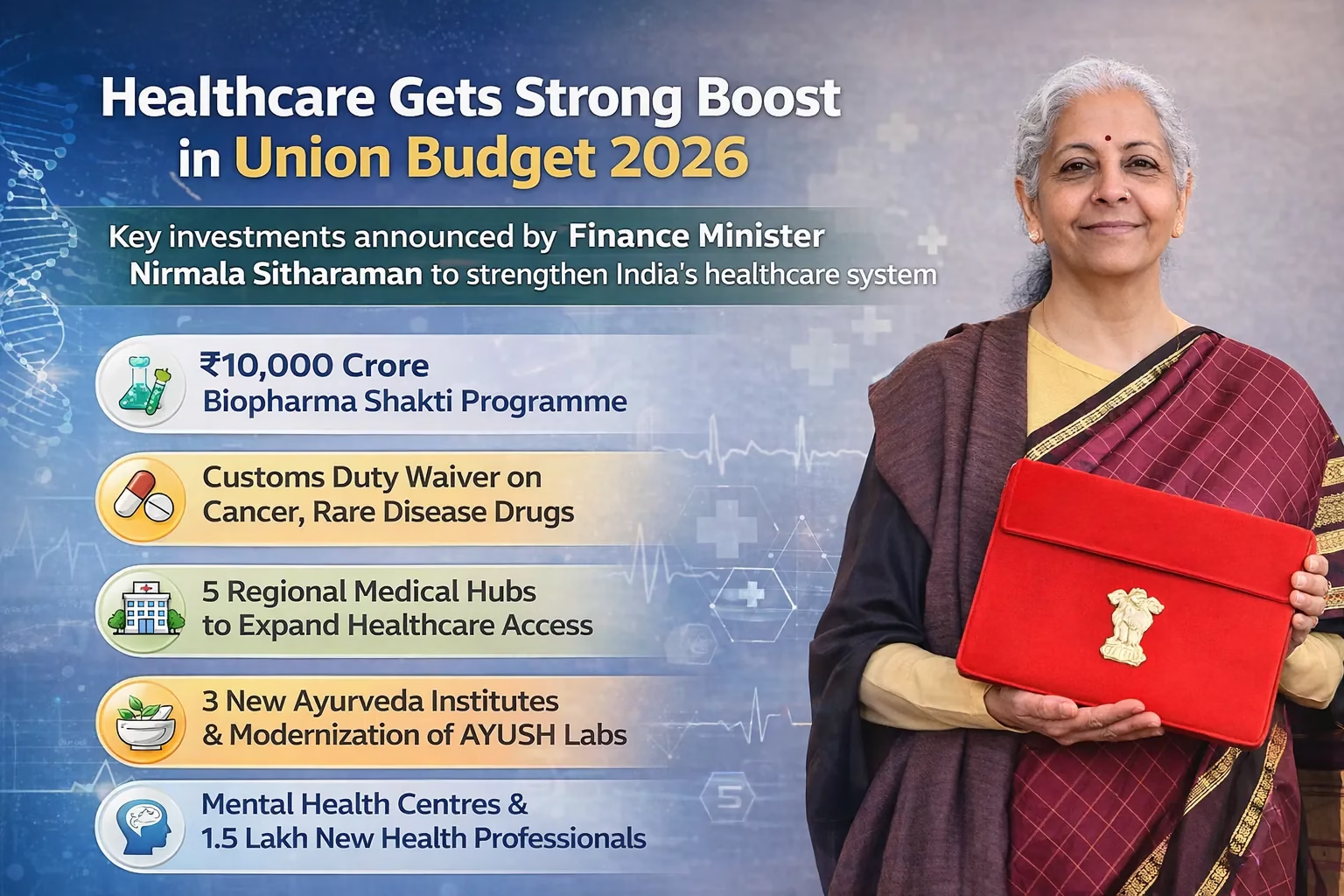

The Union Budget 2026 presented by Finance Minister Nirmala Sitharaman has received a mixed response from the healthcare sector. While industry leaders welcomed the government’s focus on innovation, affordability, and medical infrastructure, many of their key pre-budget expectations particularly around taxation, R&D incentives, and broader funding remain only partially met.

The government’s new ₹10,000 crore “Biopharma Shakti” programme was the most significant announcement for the healthcare industry. The initiative aims to strengthen India’s manufacturing capacity in biologics and biosimilars, promote innovation, and reduce dependency on imported critical drugs. This move has been well-received by the pharmaceutical industry, which had been pushing for long-term policy support to boost domestic R&D and make India a global biopharma hub.

However, several other major expectations of the pharma sector, such as restoring weighted tax deductions on R&D expenditure, expanding the Production-Linked Incentive (PLI) scheme for active pharmaceutical ingredients (APIs), and offering tax holidays for innovation clusters, did not find mention in the Budget. Industry bodies like the Indian Pharmaceutical Alliance (IPA) called the new biopharma scheme “a step in the right direction,” but expressed disappointment over the absence of stronger fiscal incentives for innovation and exports.

The Indian Medical Association (IMA) had urged the government to increase public health expenditure to 2.5% of GDP, reduce GST on healthcare services and consumables, and enhance funding for tertiary care hospitals. While the Budget included measures to develop five regional medical hubs in partnership with the private sector and strengthen workforce training, it fell short of the IMA’s demand for large-scale tax rationalization and increased healthcare budget allocation. Experts noted that although the intent to improve access and quality is clear, public health spending as a share of GDP remains modest.

For the MedTech sector, the expectations were centered around expanding the PLI scheme for medical devices, rationalizing import duties, and simplifying GST for diagnostic equipment to promote domestic manufacturing. The Budget’s announcements around innovation and medical hubs may indirectly benefit the MedTech industry, but there were no specific incentives or reforms addressing its structural challenges. Stakeholders in the sector described the Budget as “progressive but incomplete,” emphasizing the need for targeted policies to support India’s growing medical technology market.

On the affordability front, the government’s decision to waive customs duties on 17 cancer drugs and medicines for seven rare diseases drew wide appreciation from healthcare associations. The move is expected to significantly reduce treatment costs for patients suffering from life-threatening diseases and was one of the most lauded healthcare measures in this year’s Budget.

The Budget also highlighted investments in mental health, including new centers modeled on the lines of NIMHANS and the training of 1.5 lakh caregivers and allied health professionals, which experts view as essential for strengthening India’s healthcare workforce.

In short, this Budget has been seen as a positive but cautious step for the healthcare sector. It addresses critical issues like innovation, affordability, and workforce development, but leaves several long-pending industry demands unfulfilled. As one senior health policy expert put it, “The Budget sets the right direction but stops short of the depth and fiscal push the sector was expecting.”